|

The Market

Friday 5th January 2001

THE MARKET

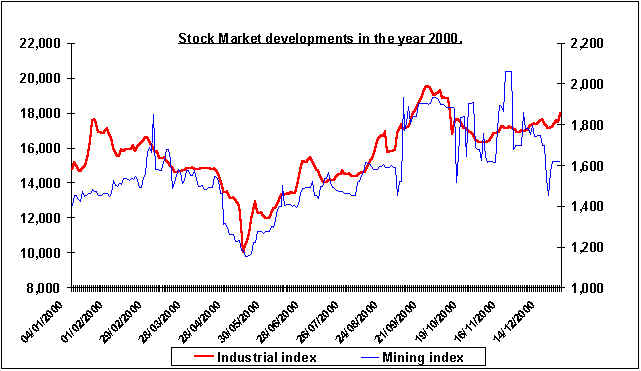

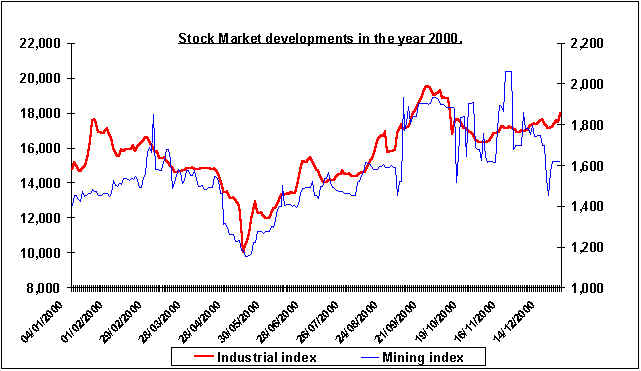

In the just ended year, the ZSE had a disappointing performance, as political

developments took centre stage. The industrial index closed the year up a

dismal 22%, way below the gain of 125% in the previous year, while the mining

index was up by 15% as commodity prices remained weak. In US dollar terms the

industrial index was down 16% while the mining index was down by 20%.

Violence characterised the June elections in which the opposition MDC

surprised the ruling ZANU PF party by clinching 57 seats. The violence and

Government reaction attracted a lot of adverse attention from the

international community, resulting in foreign investors exiting the country

for more stable emerging markets. After the elections, violence on war

veteran occupied farms escalated disrupting economic activities and further

depressing the economy.

Despite numerous calls from business and regional political leaders, the

violence has persisted and lives have been lost further depressing investor

sentiment. The government has since embarked on a fast track land

resettlement exercise but has not been able to offer the resettled farmers

required inputs or infrastructure to assist in getting the new farmers

started. This has raised numerous concerns about the food and foreign

currency supplies in the year. Already tobacco output is forecast to be 30%

down whilst prices are expected to remain flat. There is unlikely to be an

immediate maize shortage because the GMB was unable to buy

off all maize from farmers due to financial constraints.

On the other hand, seed shortages in the year 2002 are likely to develop as

nearly half of the country certified seed growers have been affected by the

land resettlement exercise. This is disheartening because there is strong

evidence that Zimbabwe is becoming a leading regional seed grower, through Seedco,

whose regional seed sales are expected to be $1 billion in the year to

February 2001. Seedco, currently trading at 630 was up by

68% in the year 2000. Investors have been anticipating a good dividend from

the company. Other agro-industrial companies have not been spared as their

farms have either been listed or occupied by war veterans disrupting their

farming and downstream operations.

This has dealt a major blow to profitability as companies have lost their

export markets after failing to supply commodities on time. The only

agro-industrial counter to perform well in the year 2000 was Cottco,

which has benefited from firm cotton prices. The company, whose year ends in

March, is expected to do well and the share price jumped 848% to 1650 at the

end of December 2000.

Manufacturing companies came under tremendous pressure during the year 2000,

as interest rates soared while demand for products was generally weak as

consumer incomes declined. Macmed, Randalls

and Merspin asked for the suspension of their trading on the

ZSE as they failed to pay off creditors. A number of

companies also released cautionary statements warning shareholders of

expected low profits and corporate restructuring. The strain on manufacturing

companies was all too evident in the financial results reported by the

companies in the year 2000. Because of the intense linkages between

commercial agricultural activities and manufacturing, the disruption in the

agricultural sector contributed immensely to the decline in manufacturing

sector. This contributed significantly to the volatility of the market as the

chart below shows.

The tourism sector was also adversely affected by the harsh economic and

political climate during the year. Zimsun is expected to

report a loss for the year to March 2001. The share price was down 52% during

the year 2000. RTG was listed on the ZSE at

150 but closed the year at 55, 63% below the issue price, as trading

conditions worsened. In the year 2001, tourism companies are likely to remain

distressed as tourists shun the country until the 2002 presidential elections

are out of the way. The persistent violence in by-elections and on farms has

worsened the country's image. Increasingly investors and tourists alike view

the tension in the country as potentially explosive and dangerous.

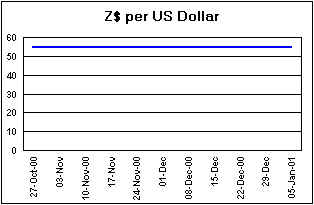

Mining counters were also depressed during the period as commodity prices

remained low and the Zimbabwe dollar/ US dollar exchange rate was fixed.

Operating costs continued to rise driven by inflation and some gold mines

were shut down as the gold price resisted the US$280 per ounce barrier. This

was despite strong growth in Europe and America. Zimbabwe lost one of its

potentially lucrative foreign currency earner, the BHP

platinum mine, as the Australian investors withdrew form the mining project,

sighting logistical problems. Platinum prices on the other

hand continued to rise from US$545 to US$602 per ounce by the end of the year

2000. Copper prices did not recover either and this

culminated in the closure of Mhangura Copper Mines. In his

2001 budget statement the Minister of Finance offered some tax incentives,

including ring fencing for the sector in order to assist in the recovery of

the ailing sector. A number of companies in the sector have been making

losses as a result of the difficult trading conditions and will not benefit

from the tax incentives at this moment.

Financial counters also had a fair share of problems in the year 2000.

Specific provisions were substantially up as companies failed to repay loans.

The compulsory acquisition of commercial farms also left a number of banks

exposed as the governments insists that it will not pay for the land and the

farmers loan obligations. In 1999, financial counters were the main driver

behind the 125% rise in the industrial index. Barclays

closed the year unchanged at 1600. NMB closed the year up

400% to 17500 followed by Old Mutual up 77% to 18700. Kingdom

was also up 70% to 920. The counter has since reached an all time high of

1200. Investors are excited about the company's retail banking project.

On the macro-economic front, Zimbabwe's crisis worsened in the year 2000 as

inflation remained high because of the government lax fiscal policy.

Inflation averaged 58% in 1999 is now expected to average 57% in 2000,

assuming a slight increase in the December figure. This environment affected

the operations of many companies as interest rates soared whilst consumers'

purchasing power fell. Operating margins for companies were consequently down

in 1999 and companies began to downsize and rationalise their operations. The

main cause of inflation has been the financing of the budget deficit through

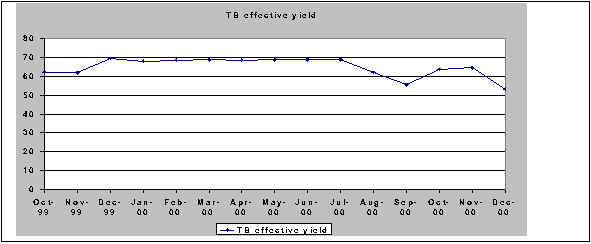

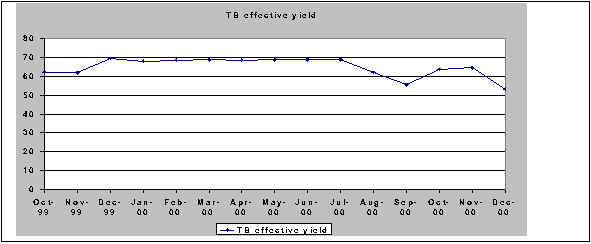

domestic borrowing. Below is the chart showing the 90-day effective TB yield.

As a result of persistent inflation short-term interest rates have remained

high discouraging any meaningful investment in manufacturing projects.

Because of the high cost of capital, companies found it difficult to expand

existing production capacity as demand was also weak.

Hardest hit by the high interest rates were companies that were heavily

geared and were unable to service their debt. A number of companies either

closed down of rationalised their operations to survive. A chronic shortage

of foreign currency also developed as the government officially controlled

the US dollar/Zimbabwe dollar exchange rate. This negatively affected

exporters as their competitiveness on the international markets was eroded.

The shortage of foreign currency persisted in 2000 resulting in a critical

shortage of fuel and disruptive power cuts. Manufacturing and mining

companies were hardest hit during this period. Overall manufacturing output

was down by 5,2% in 1999 and is expected to decline by 10,5% in the year

2000.

We expect the manufacturing sector, especially import and agriculture

dependent sub sectors to deteriorate further in 2001 as a result of

persistent forex shortages and weak domestic demand. The decline in the

manufacturing activity has been worsened by the land crisis, which has seen

the demand for agro-industrial products falling. Luxury goods have not been

spared, as consumers rearrange their baskets in favour of basic commodities.

The government is facing increasing pressure from consumers to reduce the price

of basic commodities. In 1999 following some food riots in January the

government resorted to controlling the prices of basics in order to cushion

consumers. The impact of this on profits was particularly felt by companies

in the milling and baking industry, resulting in the closure of some

companies.

It Is also anticipated that consumers will continue to experience erosion of

their purchasing power as inflationary pressures arising from food shortages

intensify in 2001. Although inflationary pressure was stronger in 2000 when

compared to 1999, annual inflation slowed down whilst month-on-month

inflation remained high. The raising of the tax threshhold from $30 000

(US$545) to $60 000 ($1090) per annum in January 2001 did raise some hopes

that consumption of luxury products could be stimulated but given the

prevailing harsh economic climate consumers are likely to continue going for

basics. This is particularly true for low and medium income earners who are

increasingly finding it difficult to cater for their basic needs.

Consequently capacity utilisation has been cut as unit costs escalate while

the demand for most commodities, especially those considered to be luxuries

by consumers has fallen. It is also important to note that the harsh economic

climate has not only led companies to restructure and downsize, It has also

resulted in consumers rearranging their consumption baskets in favour of

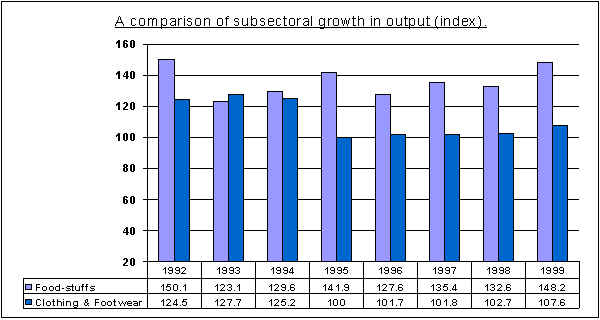

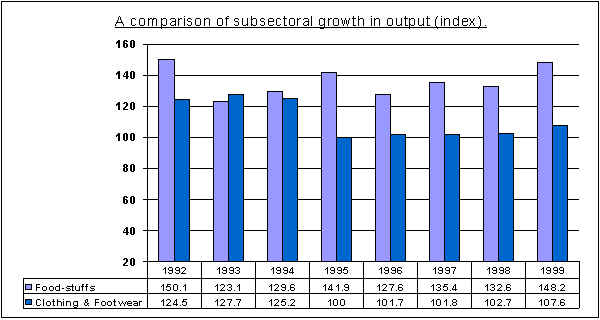

basic commodities. The chart below compares foodstuff and clothing and

footwear output growth.

As the chart illustrates food output in the manufacturing sector has grown in

1999 after registering a slight decline in 1998 whilst clothing and footwear

out has been more else stagnant. The outlook for the Zimbabwean economy,

particularly the key economic growth driving sectors Agriculture and

manufacturing, is rather gloomy as already pointed out. Unless the government

changes its policies the economy is expected to continue deteriorating with

disastrous consequences on both workers and employers alike. Key to the

recovery of the economy are the following factors.

·

The swift resolution of the land issue and

restoration of the rule of law

·

Withdrawal of troops from the DRC, which should help

in reducing foreign shortages

·

Restoration of relations with the International donor

community to alleviate foreign currency shortages and reduce interest burden

on debt

·

Reduction in government recurrent expenditure and

focussed development of infrastructure to encourage investment

·

Consistent policy implementation.

|